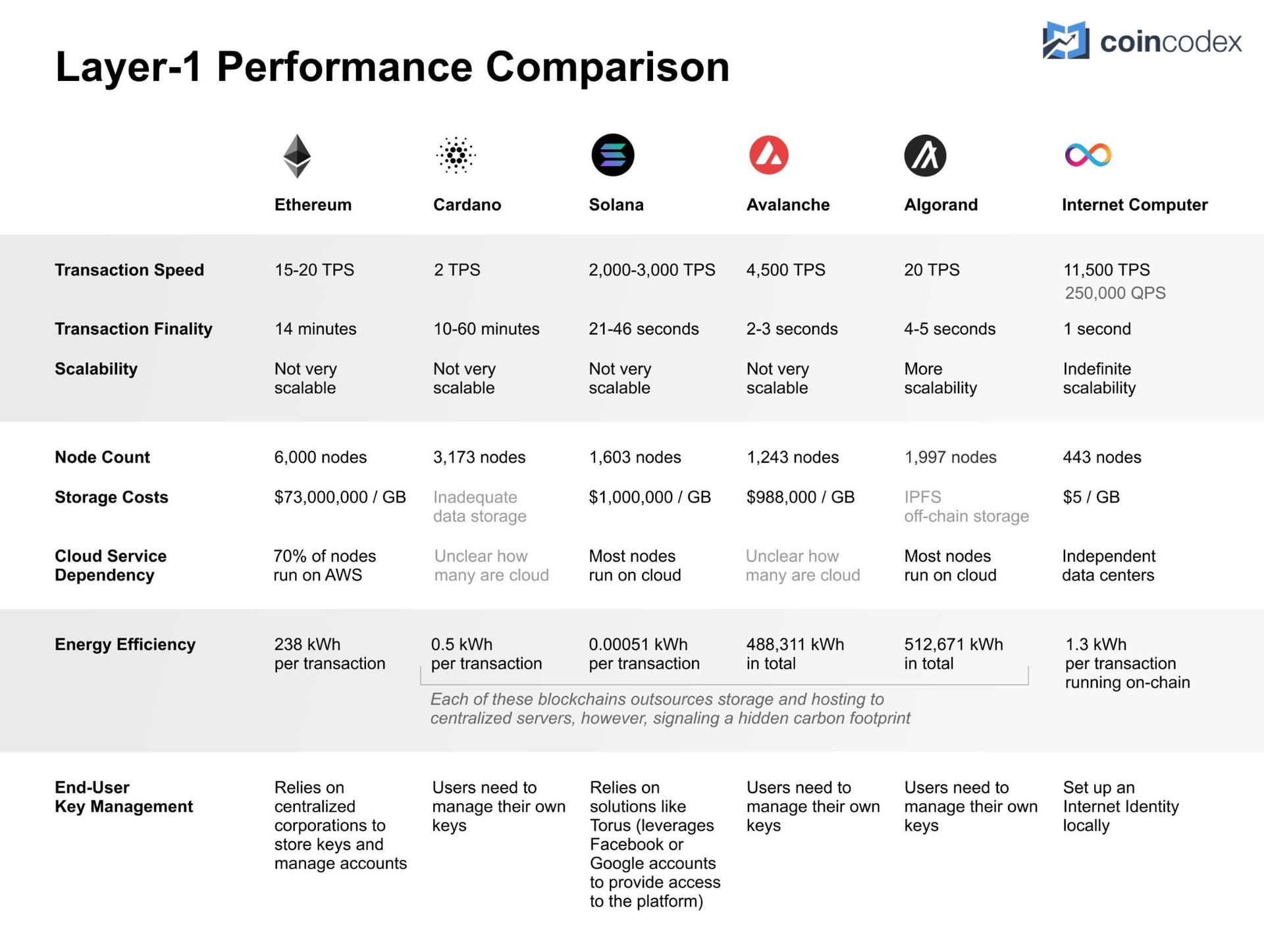

Layer 1 blockchain performance comparison can help you decide which L1 network is best for your needs. Characteristics like transaction speed, finality, scalability, node count, storage costs, and energy efficiency underline the performance of a Layer 1 network and paint a picture of its blockchain performance.

Satoshi Nakamoto’s development of Bitcoin and blockchain signaled the potential to revolutionize global finance. Then the introduction of Ethereum smart contracts enabled the growth of decentralized applications (dApps) beyond the control of centralized corporations. But Bitcoin and Ethereum are both limited in their performance, leading many to believe that blockchains are inherently slow, expensive, and difficult to scale.

An array of layer-1 protocols have emerged that aim to improve these shortcomings across different use cases. Though it can be difficult to compare blockchain protocols owing to differences in performance metrics and data, elements like transactions, scalability, nodes, and energy efficiency can help assess their relative merits.

With this in mind, let's compare six blockchains — Ethereum, Cardano, Solana, Avalanche, Algorand, and Internet Computer — based on these parameters.

Please keep in mind that some other data presented in the graphic changed since the image was first made. For example, Ethereum's energy efficiency has improved greatly since the PoS transition in 2022 and now stands at 0.03 kWh. Check the sections below for more information.

Layer 1 blockchain comparison: An in-depth performance analysis

In the sections that follow, we are going to analyze the blockchain performance of the leading Layer 1 networks in the industry based on their transaction speed, time to finality, scalability, node count, storage costs, cloud service dependency, energy efficiency, and end-use key management.

Layer 1 TPS comparison: Transaction speed

One of the key metrics determining the efficiency of a blockchain network depends on how fast it can process transactions. This involves two specific aspects: transactions per second (TPS) and block finality or transaction finality. TPS refers to how many transactions the blockchain can successfully process in a second; block finality represents the duration between a block's initiation and its final, irreversible settlement on the distributed ledger.

Cardano: 2 TPS / 10-60 minutes finality

Cardano can purportedly process 250 TPS, with a reported block finality time of 10 minutes to an hour, depending on network congestion. Its layer-2 scaling solution, Hydra, is said to theoretically enable up to one million TPS and instantaneous block finality. But third-party measurements have shown Cardano currently supporting only roughly 2 TPS.

Ethereum: 15-20 TPS / 14 minutes finality

Ethereum generally handles 15-20 TPS, with a block finality time of 14 minutes. This rate is much higher during periods of extreme network congestion, and finalizing transactions can take over 14 minutes. Users generally have to pay “gas” fees per transaction that vary depending on traffic and which peaked at a whopping $1,000 in 2021 due to network congestion. Ethereum is trying to correct this, with upcoming sharding and layer-2 scaling solutions expected to improve transaction speeds.

Algorand: 20 TPS / 4-5 seconds finality

Algorand theoretically reports processing 1,200 TPS and intends to increase it to 3,000 TPS with instant finality. According to its metrics page, it actually processes 20 TPS in practice. Algorand boasts of a block finality time of 4-5 seconds.

Solana: 2,000-3,000 TPS / 21-46 seconds finality

Solana theoretically boasts of processing 65,000 TPS, but in practice, it processes around 2,000-3,000 TPS. It suffered an outage when the transactions peaked at 400,000 TPS in September 2021, raising concerns about its instability. However, the network managed to improve upon its stability, experiencing just one outage in 2023 so far. Solana’s theoretical transaction finality time is 400-500 milliseconds, but it actually takes 21-46 seconds for “optimistic confirmation.”

Avalanche: 4,500 TPS / 2-3 seconds finality

Avalanche reported that its testnet could process 4,500 TPS, with the production-ready version eventually aiming for 20,000 TPS. But at the moment, it can process only around 9 TPS for the EVM-compatible C-Chain. Avalanche has a reported transaction finality time of less than one second but it may take about 2-3 seconds.

Internet Computer: 11,500 TPS / 1 second finality

Internet Computer is currently configured to process up to 51,666 TPS, but recent performance tests demonstrated 11,500 TPS with a finality rate of one second for dApps. This high rate results from the blockchain’s distinction of update calls (state-augmenting) from query calls (state-neutral). Internet Computer can process over 250,000 read-only query calls with execution in milliseconds.

Scalability

Blockchains are scalable when they support high transaction throughput and can grow to accommodate new users. A scalable blockchain is one where network traffic doesn't significantly hamper overall performance.

Ethereum: Not Very Scalable

Ethereum has greatly improved upon its scalability following the Proof-of-Stake (PoS) transition in 2022. It plans to have 64 shard chains with a Beacon Chain for further scalability. However, that's still a far cry compared to other more scalable chains.

Cardano: Not Very Scalable

Cardano had been similarly limited in its ability to scale and increase capacity as Ethereum. However, with the introduction of the Layer-2 Hydra upgrade in 2022, the processing of the same code, both on-chain and off-chain, has increased drastically. It is worth noting that Hydra is not as widely used as some other Layer 2s in the market, so we'd say that Cardano is not very scalable as things currently stand.

Solana: Not Very Scalable

Solana suffered from a major “resource exhaustion” in 2021 and six outages in January 2022 alone, demonstrating its limited scalability. Solana’s Proof-of-History consensus protocol, combined with PoS, also generates an enormous amount of data (two terabytes) per year. Solana stores the data in Arweave, thereby outsourcing sensitive user data to secondary sources relying on centralized Web2 technologies. However, Solana has plans to greatly increased its TPS count in the future, with some predictions speculating a 600,000 TPS limit.

Avalanche: Not Very Scalable

Avalanche has three chains: Exchange Chain (X-Chain), Platform Chain (P-Chain), and Contract Chain (C-Chain), with each chain managing mini-networks. Like Solana, Avalanche also uses Arweave and Ceramic to store data off-chain via centralized Web2 technologies, as it doesn’t have its own storage facilities.

Algorand: More scalability

Algorand uses a variation of Proof-of-Stake consensus called Pure Proof-of-Stake, through which the protocol selects block proposers and verifiers. Leveraging a cryptographic process called Verifiable Random Function (VRF), Algorand uses a self-selection algorithm to choose block creators. Different from standard Proof-of-Stake protocols, this method fast-tracks the computation process and helps Algorand to scale.

Internet Computer: Indefinite scalability

Internet Computer’s infrastructure has independent node machines at the base layer that combine to form standalone subnet blockchains. The subnets host “canister” smart contracts that combine code and data, and divide execution into update and query calls. Each subnet can process update/query calls without relying on other subnets, allowing the network to scale as needed by adding nodes and forming new subnets.

Node Count and Cloud Service Dependency

The number of blockchain nodes and their distribution is a robust indicator of a network's relative decentralization. Because the cost of storing smart contract data on-chain can be exorbitantly high, most dApps typically rely on centralized servers and cloud providers such as AWS, Google Cloud, Microsoft Azure, and Alibaba Cloud to store data and host their client-server interfaces.

Internet Computer: 1,300 nodes / $5 per GB

Internet Computer has onboarded 443 nodes running in independent data centers worldwide. None are centralized cloud providers. Node operators have hardware requirements that ensure that the blockchain can respond to HTTP requests and deliver web content without intermediaries. The cost of storing on-chain smart contract data is $5 for 1 GB of data per year.

Avalanche: 1,243 nodes / $988,000 per GB

Avalanche has documentation for setting up a node with AWS, suggesting that a significant percentage of its 1,243 nodes might be hosted on AWS. It costs $988,000 to store 1 GB of data on-chain.

Solana: 2,919 nodes / $1,000,000 per GB

Most Solana nodes are hosted on centralized servers like AWS. Its outages have raised concerns that if 33% of nodes were to go offline, Solana would stop validating new transactions. It costs roughly $1 million to store on-chain data on Solana.

Algorand: 1,720 nodes / IPFS off-chain storage

Algorand reports having roughly 1,720 nodes, but they are hosted on centralized servers. Although an exact number is not available, Algorand relies on AWS to scale its network. Instead of on-chain storage, Algorand uses the InterPlanetary File System (IPFS) to store data.

Cardano: 6,000 nodes / inadequate data storage

The Cardano Foundation, along with IOHK and Emurgo, initially established the nodes to run the network. They handed over the block production process to the network’s stake pool operators, which now number 6,000. It is unclear how many are cloud. Cardano is an append-only ledger that records asset ownership and transfers, and is impractical for permanently storing files.

Ethereum: 11,800 nodes / $73,000,000 per GB

Ethereum has around 11,800 nodes around the world, with a majority of them running on centralized servers. In 2020, Decrypt reported that 70% of Ethereum nodes ran on AWS. The cost of storing 1 GB of data on Ethereum mainnet fluctuates, but currently costs more than $100 million.

Energy efficiency

Blockchain technology must reduce its carbon footprint to become sustainable. Energy-intensive Proof-of-Work consensus adversely impacts the climate as miners need enormous energy to power their equipment.

When still on the PoW system, estimates showed that each Ethereum-based transaction consumed 238 kWh (kilowatt-hours) of energy. (For reference, 100,000 VISA transactions consume 149 kWh of energy.) Ethereum miners consumed around 45 TWh (terawatt-hours) of energy per year. Ethereum’s transition to Proof-of-Stake has decreased its energy consumption substantially, by some estimates by more than 99.9%.

Internet Computer consumes 1.3 kWh of energy per transaction running on-chain, rather than outsourcing to centralized cloud providers.

Existing Proof-of-Stake blockchains consume small amounts of energy for individual transactions. Cardano consumes just 0.5 kWh for a single transaction, while a transaction on Solana consumes 0.00051 kWh of energy. A Crypto Carbon Ratings Institute report shows that Avalanche consumes 0.00476 kWh per transaction, and Algorand consumes 0.0027 kWh per transaction. Each of these blockchains outsources storage and hosting to centralized servers, however, signaling a hidden carbon footprint.

Inter-chain bridges

Blockchain bridges support the transfer of data packets and digital assets between two separate chains. Cardano relies on the Force Bridge to transact with the Nervos blockchain and partnered with Bondly to connect Ethereum and Cardano NFTs. Avalanche uses the Avalanche Bridge to execute asset transfers with Ethereum.

Algorand will eventually use the London Bridge to connect with Ethereum. Similarly, Swingby is developing Skybridge to connect Bitcoin with Algorand, and Solana uses Wormhole to connect with Ethereum. Hackers recently stole $320 million worth of crypto from Wormhole, and various exploits have shown how bridges are susceptible to hacks from malicious actors. Hackers have stolen more than $1 billion in cryptocurrency over the past year across seven incidents, according to research by Chainalysis.

Internet Computer has the Terabethia bridge to connect with Ethereum. It also supports bridge-less inter-chain integrations, relying solely on the trustless properties of the blockchains. It is integrating with the Bitcoin network, with an API available for developers to build Bitcoin smart contracts. Integrations with Ethereum and Dogecoin will follow.

End-user key management

Blockchain adoption is still quite slow because users are wary of security key management that requires safe storage options. Web2 applications like Facebook and Google rely on easy single-sign-on (SSO) solutions. Whereas for most Web3 dApps, users have to use complex private keys and set up a crypto wallet to access the platforms.

On Internet Computer, users can set up an Internet Identity locally, using their mobile devices’ fingerprint sensor, facial recognition, security pin, lock pattern, and so on. The Internet Identity helps users authenticate themselves anonymously, without worrying about private keys. It also works on a “reverse-gas” model where developers charge smart contracts with cycles, so users don’t need to hold tokens to pay for gas.

Ethereum relies on centralized corporations like AWS to store keys and manage accounts, while Solana relies on solutions like Torus that leverage Facebook or Google accounts to provide access to the platform. Unfortunately, this compromises the decentralized ethos of blockchain technology.

Avalanche users need to manage their own keys, similar to Cardano users and Algorand users, which can involve complicated keys and token wallets.

The bottom line: Blockchain performance largely determines how useful a crypto network really is

Ultimately, the best-performing blockchain is the one that offers the most value for developers and users across a variety of use cases — namely, things like DeFi, NFTs, games, and various dApps. To that end, it’s a matter of understanding what a given layer-1 protocol offers in terms of developer and user experience and the promise of its ecosystem and relative capabilities.

It will be interesting to look beyond the performance metrics to see what the near future holds in store for each of the blockchain networks discussed above.

In the meantime, you can check our selection of the cheapest cryptocurrency networks for transfers, which allow you to save on transaction costs and engage with DeFi and NFT products and services at an accessible cost.

腊月